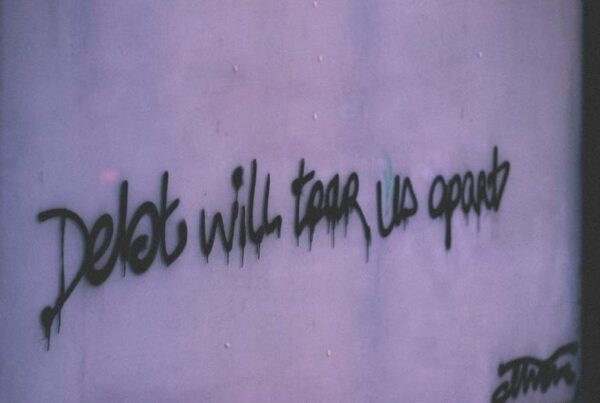

As construction companies collapse left, right and centre, make sure you’re protecting your sales ledger with the strong foundations of trade credit insurance.

Optimum Recoveries recently hosted the webinar ‘Trade Credit Insurance: Safeguard Your Business in 2022?’ featuring a presentation from Nikki Pryer – the Trade Credit Growth Leader from Marsh Australia and New Zealand. Her presentation focused on why trade credit insurance is the best line of defence for your business, and how it can save you from being impacted by the current instability within the Australian construction industry.

While many businesses use trade credit to distribute stock and build partnerships, it’s only a viable revenue stream as long as payment comes through. The fragility of such an arrangement becomes painfully obvious whenever circumstance gets in the way of your business receiving payment on time. But, as this webinar proved, there is a way to have a safety net underneath all of your trade credit transactions.

Trade credit insurance is the safety net to fall back on whenever faced with non-payments, providing up to 90% pay-back from unpaid invoices. With so many benefits and applications to trade credit insurance, it’s a no-brainer for businesses who sell on credit within the construction industry.

Watch Trade Credit Insurance: Safeguard Your Business in 2022

The Benefits of Trade Credit Insurance

In her presentation, Nikki used her years of experience and insights on the subject to outline some of the key benefits of trade credit insurance.

What Does Trade Insurance Cover?

When businesses trade on credit terms, and the buyers fail to meet their payment obligations, a trade credit insurance policy will provide protection against these payment defaults.

“Take control of what could be considered uncontrollable” – Angela McDonald

But Why Do You Need Trade Credit Insurance?

Trade credit insurance is the protection your business needs to mitigate the financial damage caused from unpaid invoices. This overall benefit can be broken down into various other reasons including:

- Protecting your business from potential bad debt

- Enhancing working capital by facilitating access to improved financing

- Embedding credit management discipline

- Helping grow your business

What Businesses need Trade Credit Insurance?

There are several types of businesses who would benefit from having a trade credit insurance policy. These include:

- Any business who sells goods or services on credit

- Domestic and export trade

- Political risk cover on export trade in other countries

- Trading in various sectors such as:

- Building and construction

- Advertising and media

- Electrical wholesale

- Electronic goods

- Steel

- Food and beverage

- Manufacturing

- Produce

- IT

- Pharmaceutical

- Mining

Your business won’t need trade credit insurance if you deal in government sales or intercompany/related sales.

How are Trade Credit Insurance Policies Implemented?

Trade credit insurance policies are flexible in their implementation, making it an even more attractive option for businesses. Insurance can be accepted on an invoice-by-invoice basis, so you don’t have to worry about agreeing to monthly fees that may or may not be required.

“If they have trade insurance and they were able to claim on their policy and get paid, that could be the difference between life and death for that business”. – Nikki Pryer

Additional Resources

This webinar is only the beginning of your trade credit insurance journey. If you would like to learn more about the topic, be sure to read/watch these additional resources.

- PPSR Webinar Featuring Lynn Walton from Accessii

- Marsh Trade Credit Questionnaire

- Trade Credit Brochure

Get in Touch

If you would like to get in touch with Nikki Pryer about trade credit insurance, you can contact her at nikki.pryer@marsh.com or on 07 3115 4540.