Is your business heading in the right direction?

Optimum Recoveries invites you to watch a recording from our informative webinar featuring Brad Bulow from SBB Partners. During the session, Brad will talk you through the numbers you should be looking at now to ensure a strong 2022 for your business.

Brad’s forward-thinking approach will look at which numbers in your financial reporting you should be paying close attention to in order to drive your business forward. Now is a good time to look at your numbers and start planning for the year ahead.

Data from the Australian Bureau of Statistics indicates that businesses who continue to spend money on marketing, innovation and resourcing are performing the best. Businesses who have a plan or roadmap and a final destination in mind consistently outperform businesses who don’t.

In this webinar, Brad will give you the confidence to jump in the driver’s seat and steer your business towards success in 2022.

You will learn:

- How to confidently take control of your business

- How to set goals with meaningful numbers to drive results for your business

- What Key Performance Indicators (KPIs) to track in your business

- How to measure staff performance and give them direction and clarity

- Why you are only just breaking even, and how to fix this

- What other problems might be at play when cutting costs isn’t working

- Why a personal budget is just as important as your business budget

You’re exactly where you need to be, but it’s still really important to ask for directions when you aren’t too sure about what to do next. We want to help you drive your business forward into a successful 2022 and beyond.

Below you will find the full webinar recording along with some notes and key takeaways from the session.

Brad Bulow:

www.sbbpartners.com.au

(07) 3812 3400

Brad.Bulow@sbbpartners.com.au

Webinar Notes:

Part of our overall mission at Optimum Recoveries is to help businesses stay in business – The world has changed, and we’ve all done a great job so far to “Pivot” with the best of them but, in 2022 how do we ensure that our house is in order to secure that position?

When it comes to business, numbers always tell a story

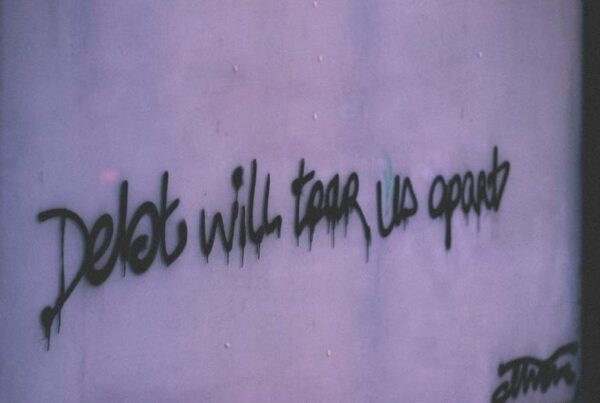

According to the Creditor Watch Business Risk Index released last week, that story is:

“Omicron bit the economy hard and smashed the optimistic expectations of thousands of small and medium enterprises”.

Their stats indicated that:

- Trade receivables continued to decline – now down around 50% on pre-Covid levels.

- The probability of default over the next 12months will hit key industries including Accommodation + Food, Information, Media and Telecommunications. Construction has been hard hit too.

- The number of payment defaults, debt related Court actions and Insolvencies are elevated – Court actions by a whopping 58% on pre-Covid levels.

So…. Navigating with Numbers to keep your business on course is a must.

1. How to confidently take control of your business

- Purpose

- People

- Prospects

- Profits

2. How to set goals with meaningful numbers to drive results for your business

- Know benchmarks – industry/competition

- Know Key Performance Indicators

- Budget v Real (monitor fluctuations – why (substantiate assumptions)

- Know your numbers – fixed, variable, direct job costs, wages + on costs

- Be realistic/achievable (worst case scenarios, what if scenarios)

- Know your peak period, know your slow ones (ensure have cash stores or funding resources to survive)

- Communicate to team, bring on the journey, celebrate wins – measure, monitor

- Speak to advisor, invest in good accountant, virtual CFO

- What KPIs to track in your business

Financial and Non-Financial (non-financial KPIS are not money related, although they can be measured numerically)

Financial KPI’s are:

1. Gross Profit Margin

2. Net Profit Margin

3. Working Capital

4. Current Ratio

5. Quick Ratio

6. Leverage

7. Debt-to-Equity Ratio

8. Inventory Turnover

9. Total Asset Turnover

10. Return on Equity

11. Return on Assets

12. Operating Cash Flow

13. Seasonality

Non-financial KPI examples every business should consider:

- Customer satisfaction.

- On-time delivery.

- Customer retention.

- New customer development.

- Internal process productivity.

- Product or service quality.

- Company and brand reputation.

- Employee training and development.

3. How to measure staff performance and give them direction and clarity

- Clarity, job description

- Negotiables, Non Negotiables

- Simplicity

- Regular Check Ins/Feedback

- Professional development, employee investment plans

- Self-Evaluation

- Clear Expectations, Define & Measure tasks

- Client Surveys

- Role Crafting/Behavioural Profile

- Quality v Quantity, Work Efficiency & Productivity

- Non-Tangibles – peer surveys, support, culture, leadership, discretionary efforts

- Why you are only just breaking even, and how to fix this

Your business could turn over a lot of money, but still operate at a loss. Identifying your break-even point will help you to work out:

• your profitable product lines

• how far sales can decline before you start to make a loss

• the number of units you need to sell before you make a profit

• if reducing price or volume of sales will impact your profit

• how much of an increase in price or volume of sales you will need to make up for an increase in fixed costs.

a. Decrease amount of fixed costs/expenses

b. Reducing the variable costs/expenses per unit (cost of materials and labour sustainable)

(Focusing on costs isn’t always answer though – if remove HR Dept, Marketing team, innovation/R&D Team will most times have a direct impact on the top line)

c. Planning, Reset Goals, Rejig Staff Mix (consultants v employees) – look for capital raising, investing, mentor/coach

d. Improving Sales Mix, New Products

e. Increase selling prices/Billing Rates

f. Analyse in depth clients (those win on those lose on)

g. Training of staff and owner (invest in sales leadership ability to coach and develop talent)

h. Offshoring, grants, employment incentives, roster management

4. What other problems might be at play when cutting costs isn’t working

- Strategic Plan needs reshaping – vision, mission, core services, values/pillars, strategic objectives.

- Client’s don’t see value in what you are creating.

- Need to build muscle that enables growth.

- Staff disconnected, culture.

- There is good cost cutting – where reducing costs to either maintain or improve quality (e.g. reducing costs to make significant savings). Doesn’t work when not looking at bigger picture i.e. how cost cutting might impact employee and customer satisfaction as well as loyalty.

- Need to avoid ugly cost cutting (bad perception, word spreads). Customers and employees don’t want to board a sinking ship – focus efforts on where can add the greatest value for your existing and future customers (if you cut costs at expense of employees or customers, you can move down a dangerous path).

- Can set panic alarms – where can work is if cut fringes, cut admin costs, barter with other businesses.