It’s an undeniable fact that COVID has impacted small businesses over the last 12-24 months. It’s easy to assume that Australian businesses are finally out of hot water concerning impacts from COVID – and other recent economic changes – but taking a dive into some of the recent trends, we can see that may not necessarily be true.

The Key Small Business Trends to Look For

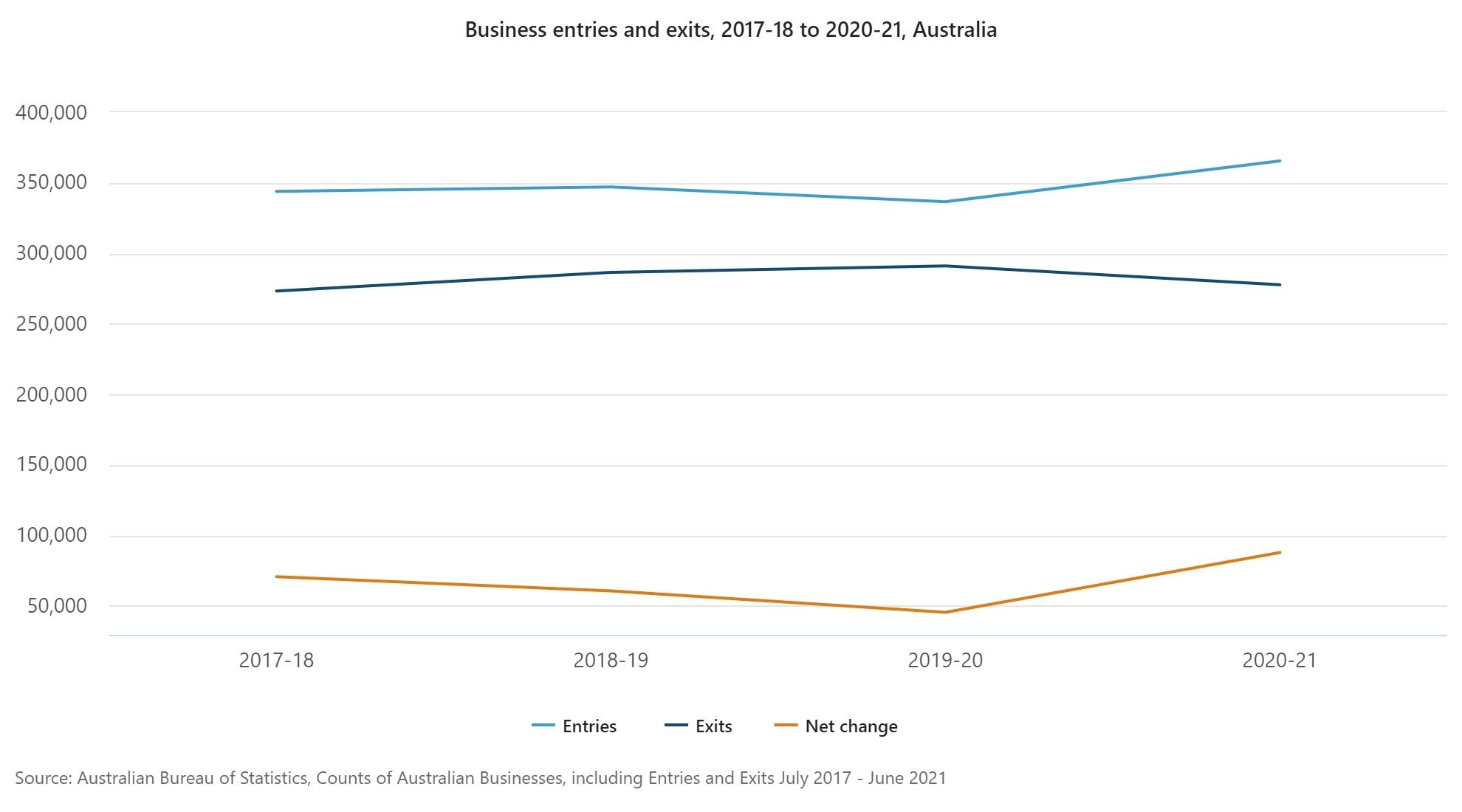

One of the biggest trends that we’re seeing is the continuous rise of new businesses. More and more Australians are leaving behind the standard 9-5 job to start their own sole-trader or small business. As of June 2021, there were over 2.4 million Australian businesses trading within Australia – an increase of over 88,000 (or 4%) on the previous year.

To put this into perspective:

- 2017-18 had 343,888 business entries and 273,237 exits, with a net change of 70,651

- 2018-19 had 346,946 business entries and 286,395 exits, with a net change of 60,551

- 2019-20 had 336,499 business entries and 291,049 exits, with a net change of 45,450

- 2020-21 had 365,480 business entries and 277,674 exits, with a net change of 87,806

Source: Australian Bureau of Statistics. (2021, Aug. 8). Counts of Australian Businesses, including Entries and Exits. https://www.abs.gov.au/statistics/economy/business-indicators/counts-australian-businesses-including-entries-and-exits/latest-release#articles

What does this data mean for the next 12-24 months?

The 2020-21 data completely reversed the previous trend where we saw more businesses ceasing to trade compared to those that were beginning. As we head further into the predicted ‘Great Resignation’, it will be interesting to see how these numbers shape up come the 2021-22 financial year. Will we have permanently reversed the trend of decreasing business registrations, or has COVID just delayed the inevitable?

Many of these new businesses were started by people who had their employment situation change, particularly those who had become unemployed or underemployed. These new business owners have finally taken the plunge after having innovative ideas burning in the back of their minds for some time. Their thinking: ‘if not now, when?’.

On the other hand, looking at the number of businesses who have exited trading in 2020-21, the tides may very well turn for the 2021-22 year. This financial year has seen significantly fewer Government subsidies for struggling businesses, the end of the moratorium on insolvency, and the release of ATO tax debt reports to credit reporting bureaus. In addition, the ATO this week has also announced that they are now actively pursuing outstanding tax liabilities after a very soft approach over the past two years. To add to the other moves the ATO has taken to retrieve and disclose debts, they have released their hitlist, targeting four core tax deductions that will face harsher scrutiny this tax season: record-keeping, work-related expenses, rental property income and deductions, and capital gains from cryptocurrency assets, property, and shares.

What’s the key take-away from this data?

The closure – or exiting – of a business never happens in isolation. Closing businesses often leave behind unpaid invoices, which can then create a chain reaction for more businesses in turn. Small businesses in particular feel this pain more keenly, often having less cash in the bank to use as a safety net in these situations. When all of a business’ clients start to close up shop, one or two invoices soon turn into a tidal wave of unpaid – and often unrecoverable – debt.

If you’re dealing with other businesses, whether you’re in construction, marketing, or any industry, it’s important to keep an eye on how businesses in Australia are performing overall. Part of the reason we saw a dramatic decrease in the number of exiting businesses in the 2020-21 Financial Year was because of the number of Government subsidies and grants delivered as part of the initial response to COVID. These policies allowed many businesses to continue trading in a ‘zombie’ state. As businesses start to feel the effects of trading without these subsidies, changes in their credit behaviour may start to occur.

ATO activity over the next few months may also significantly change the behaviour of both your suppliers and your clients. The ATO chasing up debt may seem like the biggest contributor to this change in activity, however that may not be case. Sole-traders and contractors may be feeling the strain from the tax deductions hitlist, and any debts your own business owes to the ATO may trigger changed behaviour if your suppliers are also doing their due diligence

Pay attention to prevent debt

The biggest step to prevent debt begins with your foundation documents. You should always start with ensuring your credit applications and terms and conditions are as watertight as can be. These will determine what your payment terms are, which can include:

- Invoice due dates

- Late payment fees

- Payment methods

- Debt collection policies

Other key steps you can take to protect your business and its assets include:

- Registering your assets on the PPSR – we have a great webinar with Lynne Walton from Access PPSR on how the PPSR can help protect your business in the case of customer insolvencies. Lynne talks about how she saved a client $6 million a year by using the PPSR – for only $6 per registration.

- Trade Credit Insurance – Watch our recent webinar with Nikki Pryer from Marsh Australia & New Zealand on how to safeguard your sales ledger with trade credit insurance. If you’ve followed the right credit procedure and policy, trade credit insurance can help you recover 80% of your losses if a company goes into liquidation.

- Do a Terms and Conditions check – Get in touch for a complimentary review of your foundation documents (including your Terms and Conditions). Solid foundation documents are one of the biggest ways to avoid debt in your business.

Make credit management a priority

Creating robust foundation documents is just the first step in managing your credit. Your foundation documents are important for protecting your business from debt, and will inform any ongoing activities that can be taken for that account – however, you should make sure they are saved in a safe, and easily found place. There’s no point to making sure you have guarantees to recover debts if you are unable to find the signed documents!

Putting a privacy clause within your foundation documents can allow you to do a credit check and monitor over the course of 12 months. With this clause, you will be able to monitor credit behaviour over the 12-month period, and receive automatic alerts on any warning signs, so that you can make an informed decision about whether you want to extend credit – or chase up outstanding invoices – for that customer.

Signs to look out for include:

- Is your client purchasing more than they would ordinarily?

- Is your client purchasing less than they would ordinarily?

- Are there any out of the ordinary purchases your client is making?

All of these behaviours can help you sense if there is an upcoming turning of the tides for that customer.

While looking at your customer behaviour, keep an eye out for any new credit procedures they are putting in place. For example, the Government will soon be moving to e-invoicing, which will see their payment times significantly reduced.

Be ready to recover your assets

The best time to recover your debts is now. Receivables are perishing assets, so if you don’t collect them or move forward with recovery, they are worth less. By the time the account is 90 days past due, the collectability of it has dropped to 69%.

It’s important to remember that taking action on an account that is overdue does not make you a shark – it makes you a conscious business owner. Continuing to avoid chasing debts will make your business bear the financial cost of a slow paying customer.

But should you take collection actions against a loyal or longstanding client? Is charging the agreed interest on late payments worth potentially losing a client? It’s key to keep in mind that collection actions don’t begin with hard actions. You may start with small actions like calls, emails, and letters – and if they aren’t responding to your efforts to resolve the debt, is that a business relationship you want to continue to foster and encourage?

If further action is needed, using a debt collection agency like Optimum Recoveries adds a third party that can help you collect the debt, without being driven by negative emotions, and help you keep your business relationships.

The right help is big for small businesses

Getting a head start on preventing, managing, and recovering your debt can help protect you no matter how the tides may turn. The economy is always changing, and largely impacts our businesses in ways we can’t control, but can make contingencies for.

If you want to discuss how we can help your business ride the waves, get in touch with our team of credit and debt specialises on 1300 556 937, or get in touch via our contact form.