OUTSTANDING INVOICES? LAST CHANCE TO GET PAID BEFORE CHRISTMAS!

With less than 30 working days left in 2016, now’s the perfect time to send us your outstanding accounts so that we can recover funds for you before Christmas!

Invoices left unpaid over the festive season become significantly more difficult to recover for the following reasons:

- Many businesses close in the second half of December, with some not opening again until mid to late January and not really getting into full operation until February.

- Cash flow is traditionally a problem for many businesses in January and February.

- Even if the business that owes you money isn’t closing over the Christmas break, many key personnel are likely to be on leave, meaning you’ll be more likely to get the ‘run around’ trying to find someone to assist.

Leave it to us, we’ll recover funds swiftly and professionally, and deposit what’s owed to you in your account before the end of the year so you can start 2017 off on the right foot.

Don’t delay!

Angela and the team

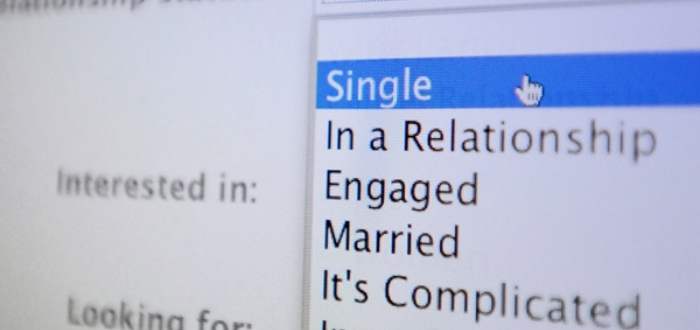

WHAT’S YOUR ‘RELATIONSHIP STATUS’ WITH YOUR CLIENT?

Personal relationships are great, but can be hard work! It can take a long time to get to know and trust each other, and know what makes someone ‘tick’. Just one wrong move and your relationship can be ‘on the rocks’ or over all together!

It’s no different in the world of business. You work hard to attract your customer and keep them happy. You make regular contact, listen, and ensure you continuously adapt and innovate to meet your clients’ needs.

And then it happens – your invoice is overdue. It’s human nature to feel let down and disappointed.

Getting us involved in these instances doesn’t mean your ‘relationship status’ needs to change to ‘it’s complicated’. In fact, it might just save your relationship!

Chances are, your invoice hasn’t been deliberately left unpaid. Our award-winning debt management services are all about ongoing cash flow management. As in any relationship, it’s all about communication. Our skilled team will sensitively contact your client to find a solution on an ongoing basis to improve your cash flow. We can even make calls in your company name if you wish. Think of us as an extension to your team.

We can assist with:

- Generating and sending invoices

- Developing more efficient invoicing procedures

- Developing innovative communication methods to encourage prompt payment

- Making follow-up cash-flow collection calls, and

- Dispute resolution that focuses on reaching a mutually acceptable and positive outcome in a timely manner.

By leaving all of this to us, you’ll have more time to build the relationship and deliver great products or services for your existing clients (and find some new ones!)

If the relationship with your client has truly progressed to ‘it’s complicated’ or ‘it’s over’ – and money is owed, leave it to us to professionally and promptly recover what’s owed to you, so you don’t need to engage directly.

MATE, THAT’S A BIT UNFAIR!

Heard about the new laws that just came into force to protect small businesses from unfair terms in contracts? The new rules apply to standard form contracts entered into or renewed on or after 12 November 2016.

Most small businesses use standard form contracts: these are ‘generic’ contracts where the other party has little or no opportunity to negotiate the terms – in other words, ‘take it or leave it’!

The law includes some examples of terms that may be unfair, including terms that:

- enable a business to avoid or limit their obligations under the contract,

- enable a business to terminate the contract,

- penalise a business for breaching or terminating the contract, or

- enable a business to vary the terms of the contract.

If a court or tribunal finds that a term is ‘unfair’, the term will be considered void – this means it is not binding on the parties. The rest of the contract will continue to bind the parties to the extent it is capable of operating without the unfair term.

There are a number of exceptions, but contracts which may be affected include:

- Franchise agreements,

- Manufacturing and distribution agreements,

- Business terms and conditions,

- Licence agreements,

- Service agreements, and

- Leases

Contact us to ensure your contracts are legally binding under the new laws.

MIND THE GAP! DEBTOR FINANCE AND COMMERCIAL CREDIT CARDS

Cash flow woes are keeping small businesses up at night. Particularly in Australia, due to the fact that we’re amongst the slowest payers of invoices in the world.

Heard about debtor finance? Also known as invoice finance, in simple terms, it’s a loan to ‘cover the gap’ and assist with cash flow while you are waiting for invoices to be paid. In other words, a line of credit linked to and secured by your outstanding accounts receivable.

There are some benefits to debtor finance:

- Better cash flow = more money to fund staff, stock or capital expenditure.

- Unlike a bank overdraft, there is generally no need for real estate security.

- It’s a standalone facility that can sit alongside other business borrowings.

- Normally there are no capital repayment requirements.

- With better access to cash flow you may be able to pay your own suppliers early and qualify for discounts.

Another form of debtor finance that many small to medium enterprises are increasingly using to ‘cover the gap’ is commercial credit cards. With up to 55 days’ interest free, these cards can be a handy way to access finance to pay your suppliers.

However, once that 55 days is up, the interest charges can really start to add up.

Additionally, if the Reserve Bank of Australia goes ahead with plans to include commercial cards in the new caps on interchange fees, lenders may be forced to cut costs by reducing credit risk, which would mean commercial cards would be harder to access.

There are also fees and risks associated with debtor finance. It may be cheaper to have us recover the debt for you earlier than to take out debtor finance. Alternatively, a review of your debtor management processes by us might help you cover the gap in a less risky and less costly way.

If you’re considering debtor finance, we encourage you to contact us first to discuss.

2016: THAT’S A WRAP!

We’ve thoroughly enjoyed working with you in 2016. We’ve received some lovely feedback from our clients:

“Impressed as always with the professionalism from your organisation”

“Pleasure working with you. Wonderful outcome again!”

In lieu of Christmas gifts for our clients, we will again be making a generous donation to Food Bank Queensland, to help out those in our communities who are doing it tough.

This year, we’ll also be supporting Lou’s Fun Fundraiser, raising awareness and funds for cervical cancer in support of a dear colleague.

As well as supporting some great causes, the other reason we’re doing this is because many of our clients suggested that we support a charity in lieu of providing gifts (due to the complexities that arise with corporate gift policies).

We’ll be taking a short break over the festive season. Our last working day for 2016 will be 16 December. We’ll then be re-opening on Monday 9 January, re-energised and ready for another great year!

On behalf of the entire Optimum Recoveries team, I’d like to thank you for your business, support and friendship in 2016 and wish you, your staff, and your families a wonderful Christmas season.

Angela McDonald